- Lagos Internal Revenue Services, LIRS, today Friday, August 5th 2022 will launch a Whistle-Blower Initiative.

Taxation in Lagos-Nigeria has received a renewed drive as all is set for the Lagos State Internal Revenue Service, LIRS to sanitise the administration better from the launch of a whistle-blower initiative.

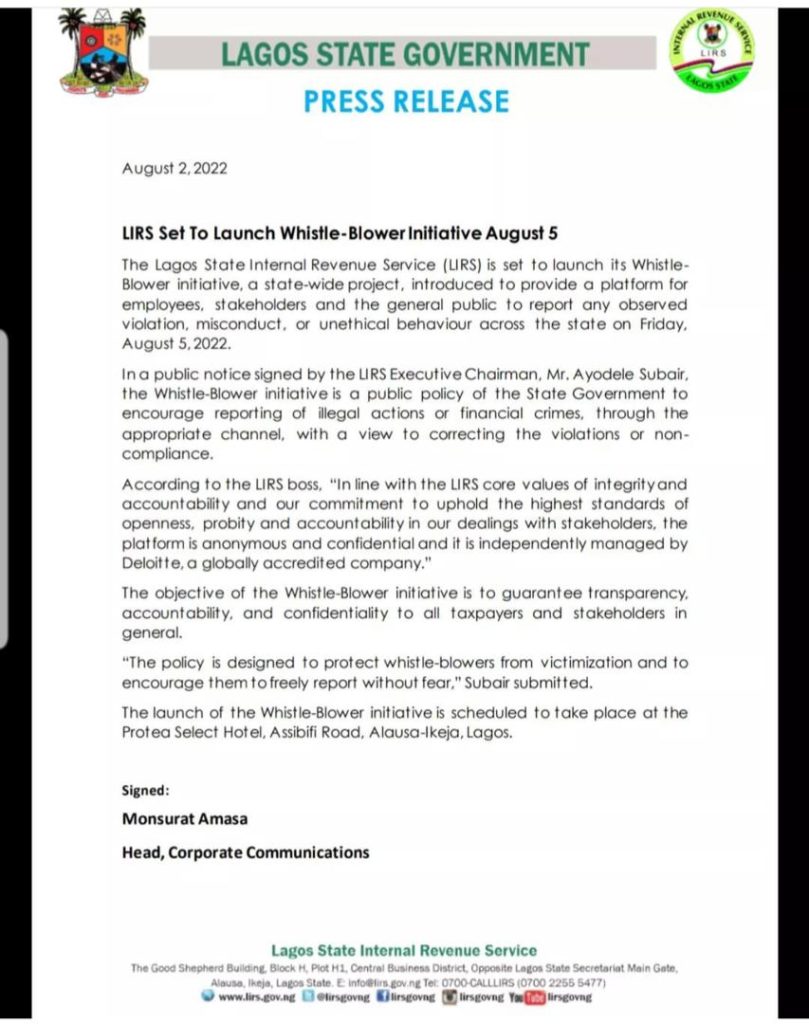

The state-wide Whistle-Blower initiative is set to kickstart today, Friday 5th, August 2022 and will open up a window where employees, stakeholders and the general public can report irregularities by an official of the revenue generating agency.

As captured by a statement from the agency, the scope of irregularities that the scheme will major in will include reporting observed violations and heads-up on misconduct or unethical behaviour by officials of the agency across the state.

In summary, Africataxreview.com gathered that the new initiative will help the state government further prevent loopholes in the system, ensuring that revenue collection is effectively optimized. This also doubles as a strategy to get everyone involved in fighting tax fraud.

While reeling out the nitty-gritty of the new direction of Nigeria’s commercial capital that is set to be launched at Protea Select Hotel, Assibifi Road, Alausa-Ikeja, Lagos, Ayodele Subair, the LIRS Executive Chairman stated that the new approach encourages the reportage of illegal actions or financial crimes, through the appropriate channel, to correct the violations or non-compliance.

Taxation in Lagos-Nigeria: The statement of the LIRS Chairman,

“In line with the LIRS core values of integrity and accountability and our commitment to upholding the highest standards of openness, probity and accountability in our dealings with stakeholders, the platform is anonymous and confidential and it is independently managed by Deloitte, a globally accredited company.”

“The objective of the Whistle-Blower initiative is to guarantee transparency, accountability, and confidentiality to all taxpayers and stakeholders in general.

“The policy is designed to protect whistle-blowers from victimization and to encourage them to freely report without fear,” Subair submitted.

See Memo Below

Follow us on Twitter for more update

DISCLAIMER

The information contained herein is general and is not intended, and should not be taken, as legal, accounting or tax advice provided by Taxmobile.Online Inc to the reader. This information remains strictly the opinion of Taxmobile.Online Inc.

The reader also is cautioned that this material may not apply to, or suitable for, the reader’s specific circumstances or needs, and may require consideration of other tax factors if any action is to be contemplated. The reader should contact his or her Tax Advisers before taking any action based on this information.

All rights reserved. No part of this document may be reproduced, retransmitted or otherwise redistributed in any form or by any means, electronic or mechanical, including by photocopying, facsimile transmission, recording, rekeying, or using any information storage and retrieval system, without written permission from Taxmobile.Online Inc.