- The year 2023 has seen a lot of changes and manifestations tax-wise, as many countries have been implementing their preplanned tax plans while some are waiting to execute theirs soon.

New Taxes for 2023 in Kenya. The Kenyan tax administration has decided to give tax generation a renewed drive since the emergence of President Ruto at last year’s presidential election.

This is on the flip side of other tax administrations introducing tax relief initiatives to ease the burden of taxpayers.

New Taxes for 2023 in Kenya

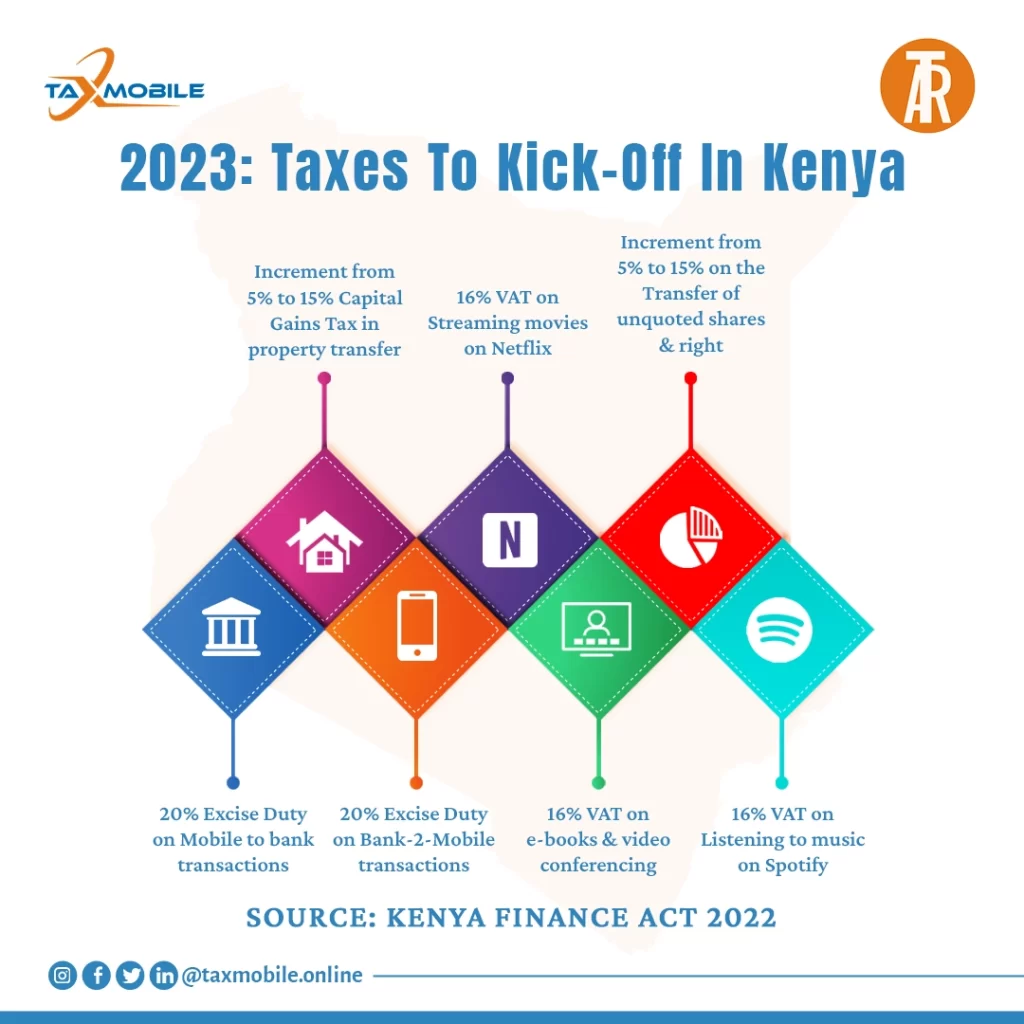

The Finance Act of 2022 majorly introduced five new taxes for the year 2023. While some of these taxes are new, others have existed previously but have now been reviewed upward.

Consequently, these taxes will no doubt affect business owners as well as consumers.

These measures are being introduced at a time when the country is operating on scarce revenue and the cost of living is insanely high.

So far, citizens have been clamoring for change as a lot of pressure is being mounted on the president to fulfill his election pledges and find a way to reduce the cost of living.

Below are the major taxes that awaits taxpayers in 2023:

15% Capital Gains Tax

One of the taxes that was reviewed is the Capital Gains Tax which was initially 5%.

The Capital Gains Tax (CGT) is a tax that is imposed on the sale or transfer of property such as land, buildings, and so on, located in Kenya.

What this means is that a property doesn’t necessarily have to be traded for money before the capital gains tax can apply.

The tax applies even when the property is exchanged, gifted out, or disposed of.

As part of the changes, the Finance Act of 2022 revised the Income Tax Act (ITA), by increasing the rate of CGT from the initial 5% to 15%.

This particular increase came into effect on the 1st of January, 2023.

16% Value Added Tax

One of the newly introduced taxes is the Value Added Tax (VAT) which now applies to digital services as the government sets its sights on the flourishing digital economy.

Also known in some countries as Goods and Services Tax (GST), Value-Added Tax (VAT) is a consumption tax charged when goods are bought and services are provided.

In the case of this particular tax though, it is already in effect as

Multinational tech companies have started applying a standard 16% Value Added Tax (VAT) on online services such as streaming movies on Netflix or listening to music on Spotify, e-books, videoconferencing, and so on.

1% Gross Turnover Minimum Tax

The minimum tax is a flat tax that applies to businesses that have an annual turnover of below Sh5 million.

When the gross turnover minimum tax was initially suggested, its execution was halted by the ruling of a lower court that didn’t agree with the Kenya Revenue Authority’s thinking.

However, the KRA has recently solicited the help of the Supreme Court to reverse the lower court’s decision.

The KRA explained that the tax was introduced to ensure the contribution of all businesses to the country’s tax base.

15% withholding tax

According to the KRA, as of 2023, a 15% withholding tax will be charged on any profit made from local-based derivative contracts.

A local-based derivative contract is a contract that is dependent upon one or more underlying assets that are located or traded within the same country.

20% Excise Tax

Last but certainly not least is the 20% Excise Tax that banks have already begun charging on transactions between mobile wallets and banks.

The tax is imposed

Although most banks haven’t informed their customers regarding the tax deduction, the tax is already in effect.

Google Directs Businesses To Submit Their KRA-issued PIN

Following the introduction of a 16% Value Added Tax (VAT) on Online Services, Google has implored businesses in Kenya to upload their KRA-issued Pin Google’s payments profile as soon as possible.

According to Google, this PIN, once uploaded, will begin appearing on their invoices and will determine the validity of their invoices.

The tech firm then announced February 1, 2023, as a deadline, warning that refusal to submit their pin before said date may result in invoice validity and could also affect the retrieval of VAT costs if they qualify for a reclaim.

Google also mentioned that starting from February 1, it will start collecting taxes on behalf of the National Government.

With this article ‘Kenya: New Taxes for 2023’ we have offered you an in-depth analysis of major changes expected in the Kenyan tax administration this year as president Ruto’s led government is looking at increasing revenue generation.

Follow us on Twitter for more update

The information contained herein is general and is not intended, and should not be taken, as legal, accounting or tax advice provided by Taxmobile.Online Inc to the reader. This information remains strictly the opinion of Taxmobile.Online Inc.

The reader also is cautioned that this material may not apply to, or suitable for, the reader’s specific circumstances or needs, and may require consideration of other tax factors if any action is to be contemplated. The reader should contact his or her Tax Advisers before taking any action based on this information.

All rights reserved. No part of this document may be reproduced, retransmitted or otherwise redistributed in any form or by any means, electronic or mechanical, including by photocopying, facsimile transmission, recording, rekeying, or using any information storage and retrieval system, without written permission from Taxmobile.Online Inc.