Tax clearance certificate in Lagos is important If you run a business or intend to run one in the commercial capital of Africa then you must take cognizance of the importance to generate a Tax Clearance Certificate, TCC.

Typically, it is always a tug of war when the need to generate a TCC arises as one has to deal with the bottlenecks paperwork, and bureaucracy among other factors that can frustrate the process. The frustration can be more when one eventually misses the deadline to file due to the rigorous process.

Lagos state, one of the biggest in Africa and the world is looking toward easing up the tax system, hence the introduction of a self-filing process summarized in the 3 steps we will be sharing below.

But before we delve in, it is important to state that the need for a TCC is statutory and thereby constitutionally binding on the taxpayer.

Tax Clearance Certificate In Lagos: General Conditions of TCC Application

One of the primary conditions for TCC application is the compulsory filing of annual income tax returns. This applies to both employers and individual taxpayers. Employers must file returns for the past three years, providing details of employment income, including compensation for loss of office. For individual taxpayers, returns must be filed for the last three years, encompassing all sources of income, including employment income and other earnings. It is essential to adhere to this requirement diligently, as any false declaration of income could lead to criminal prosecution.

Also, As part of the TCC application process, uploading your recent passport photograph is mandatory. This serves as a means of identification and validation, ensuring the authenticity of your application.

Your address plays a vital role in the application process. Before applying for a TCC, ensure that your address details, including street name, number, state, Local Government Area (LGA), and Local Council Development Area (LCDA), are up to date. This information allows the tax authorities to communicate effectively and ensure a smooth application process.

To proceed with your TCC application, you must have received tax assessments raised by the relevant agency for the past three years. These assessments are generated based on the income tax returns filed by the applicant. It is crucial to clearly understand your tax assessment history and address any outstanding issues before initiating the application.

To obtain a TCC, it is necessary to fulfil your tax obligations for the last three years preceding the current year. This entails making full payment for any taxes due or declaring your income in the annual tax returns to determine if no tax is owed. If there are outstanding assessments, it is essential to generate a bill reference before proceeding with payment.

You are on the right track to acquiring a Tax Clearance Certificate in Nigeria by meeting these conditions. It is crucial to understand the significance of this document, as it extends beyond mere compliance with tax laws. A TCC unlocks a world of opportunities, including access to contracts, tenders, favourable financing terms, and even enhancing your personal and business reputation.

Embracing these conditions and fulfilling your tax obligations demonstrates your commitment to transparency, accountability, and ethical practices. It showcases your dedication to contributing to the growth and development of Nigeria’s economy. So, take the necessary steps, navigate the tax system with diligence, and unlock the doors to a brighter future with your Tax Clearance Certificate.

Step By Step Guide to Generating TCC in Lagos

Step 1: Login as an individual taxpayer (follow the steps in h ps://etax.readme.io/docs/login-as-individual-taxpayer)

Step 2: On your profile page click on the “DOWNLOAD TCC” icon and it will redirect you to the TCC Checklist page as shown below.

Tips:

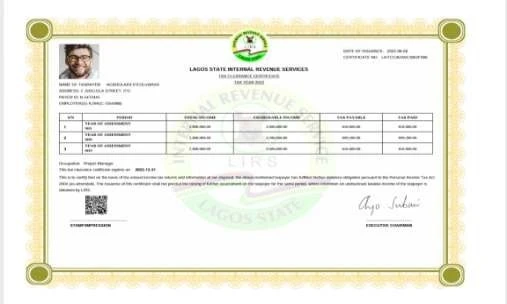

Once all the conditions are met, you will be directed to a new page to preview your TCC. The preview certificate should reveal assessment information pulled from the individual’s record. Kindly cross-check the following on this page:

- Your image;

- Employer details (where applicable);

- Occupa on informa on;

- Certificate Number;

- Scannable Barcode;

- Total Income; and

- Tax paid.

Step 3: After viewing the certificate click on the download icon to download a so copy or click on print to have a hard copy.

Follow us on Twitter for more update

The information contained herein is general and is not intended, and should not be taken, as legal, accounting or tax advice provided by Taxmobile.Online Inc to the reader. This information remains strictly the opinion of Taxmobile.Online Inc.

The reader also is cautioned that this material may not apply to, or be suitable for, the reader’s specific circumstances or needs, and may require consideration of other tax factors if any action is to be contemplated. The reader should contact his or her Tax adviser before taking any action based on this information.

All rights reserved. No part of this document may be reproduced, retransmitted or otherwise redistributed in any form or by any means, electronic or mechanical, including by photocopying, facsimile transmission, recording, rekeying, or using any information storage and retrieval system, without written permission from Taxmobile.Online Inc.