Kenya’s Parliament has officially passed the 2025 Finance Bill, setting the stage for President William Ruto’s assent.

The legislation, aimed at increasing domestic revenue collection, has sparked significant attention both for its tax compliance targets and for the withdrawal of a contentious proposal involving access to taxpayer data.

Kenya Approves 2025 Finance Law: Data Access Proposal Struck Out

A major talking point during deliberations was the Kenya Revenue Authority’s (KRA) attempt to secure unrestricted access to taxpayers’ financial information. The move drew sharp criticism from civil rights groups, opposition figures, and legal experts over potential breaches of privacy and constitutional protections.

Responding to the public backlash, the parliamentary finance committee rejected the proposal earlier in the week. Lawmakers ultimately agreed that existing legal provisions already allow KRA to obtain financial records—so long as court approval is granted.

Tax Compliance Takes Priority

Despite the data access controversy, the broader thrust of the Finance Act remains clear: strengthening tax enforcement and improving compliance.

The law is expected to help generate an additional KSh 30 billion (approximately $233 million), addressing a growing budget deficit without introducing sweeping new tax increases.

Finance Minister John Mbadi, who presented the 2025/26 budget to Parliament, reiterated that boosting revenue without destabilizing the economy is a central policy priority. The proposed KSh 4.29 trillion ($33 billion) budget relies heavily on improving tax administration.

Avoiding Last Year’s Mistakes

Observers say the government is walking a fine line this fiscal year, wary of the backlash that followed the 2024 Finance Bill. Last year’s tax proposals sparked nationwide protests, resulting in over 60 deaths and a partial rollback of the planned KSh 346 billion in new tax measures.

By narrowing its focus to enforcement and compliance rather than broad tax hikes, the 2025 law is seen as a more measured approach to domestic revenue mobilization.

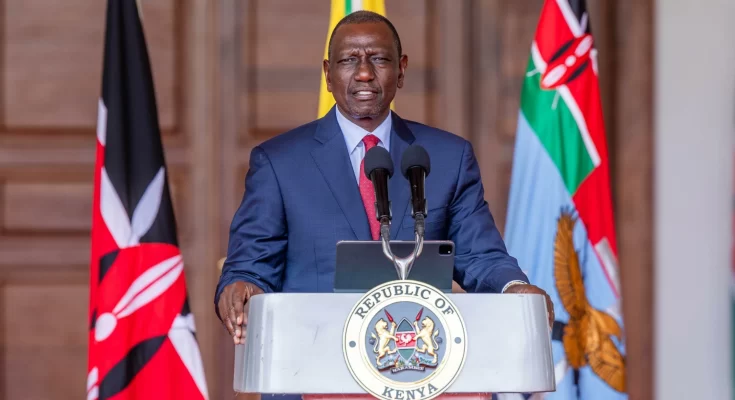

Next Steps: Presidential Assent

With legislative approval secured, the bill now moves to President Ruto’s desk. His assent would make the Finance Act law and allow its provisions to take effect at the start of the 2025/26 fiscal year on July 1.

Analysts: Compliance-Based Strategy a Safer Bet

Tax experts commenting on the development noted that while the KRA’s push for expanded access to taxpayer data was ambitious, the retreat from the proposal likely preserved public trust and safeguarded constitutional norms.

They also emphasized that a strategy focused on tightening existing loopholes, enhancing audits, and encouraging voluntary compliance could deliver long-term revenue growth without inflaming social tensions.

Fiscal Tightrope for Kenya

Kenya’s 2025 Finance Law reflects a delicate balancing act: increasing revenue while maintaining taxpayer confidence and respecting civil liberties. The coming fiscal year will test the success of this strategy, particularly in how it translates into real gains for the national treasury.

As Kenya navigates fiscal pressures and public sentiment, this year’s finance framework may serve as a model for other African economies pursuing compliance-driven tax reform.